- LINK displayed signs that it was unwilling to repeat its 2020 trend.

- On-chain metrics showed that SOL might continue to outperform LINK.

Many things have changed in the market since the last bull cycle, and one thing that might have gone unnoticed is Chainlink’s [LINK] trend.

In the last 30 days, the price of LINK has increased by 0.69%. Solana [SOL], on the other hand, had jumped by 66.23% within the same period. But it was not always like that especially when Bitcoin [BTC] halving was days away.

For instance, the price of Chainlink made a significant jump before the May 2020 halving, LINK climbed from $2.07 to $4.07. Three months later, the price doubled again.

Things are no longer as they seem

The current trend displayed by the project revealed that such performance might not repeat itself. From AMBCrypto’s investigation, this change could be due to the impact Solana has had over the last year.

Though LINK’s value increased by 182% in the last year, it was nowhere close to the 819% jump that SOL had within the same period.

Currently, Bitcoin’s halving is estimated to happen on the 19th of April. If there is no significant change in the price action within the next few days, then LINK might not move the same way it did in 2020 and 2016.

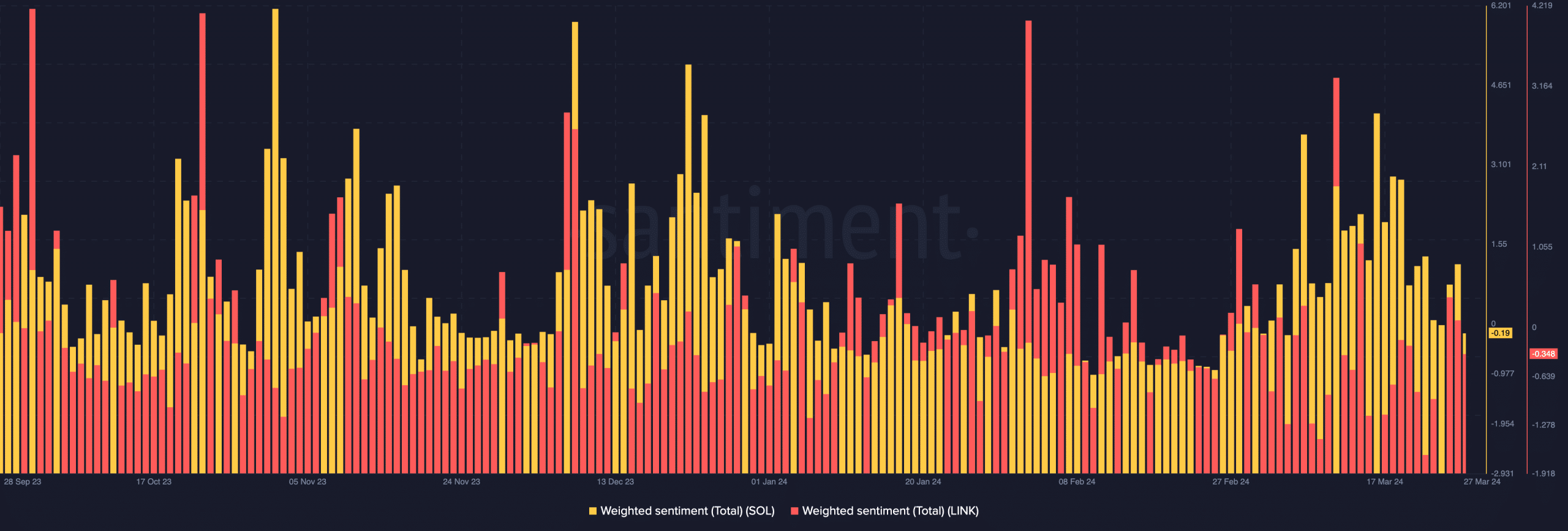

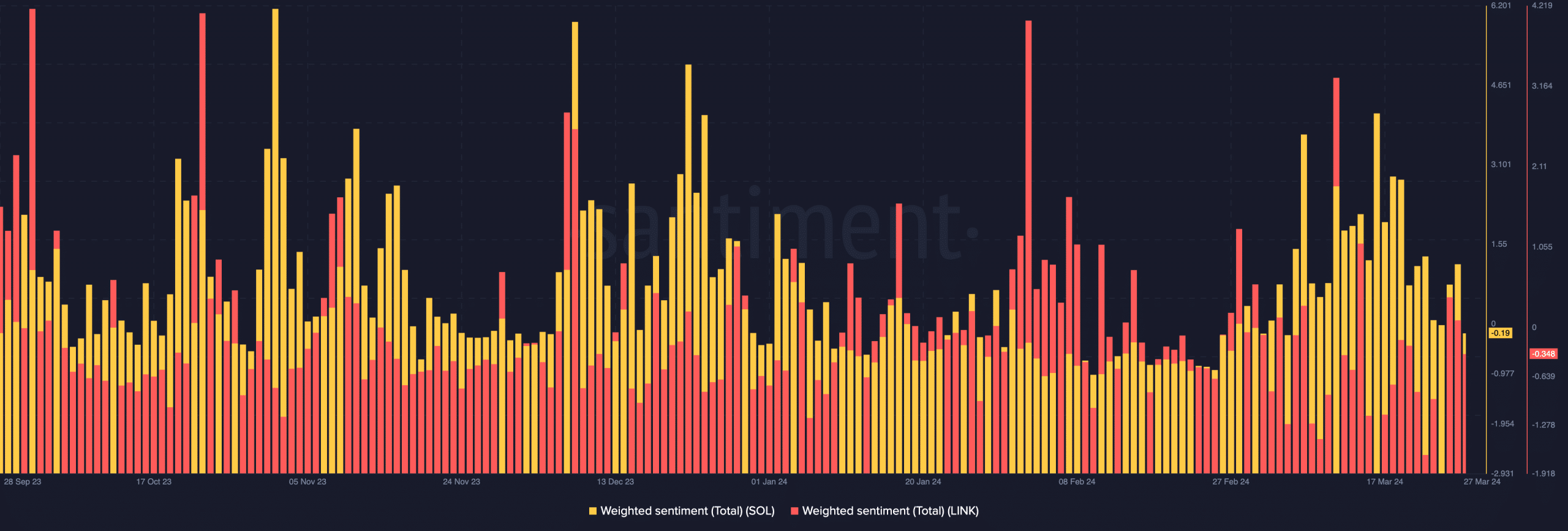

When it comes to the sentiment around both projects, we found out that they were similar. At press time, the Weighted Sentiment around SOL was negative. Chainlink’s sentiment was almost indistinguishable from its opposite number.

Source: Santiment

These negative readings suggest that traders expect the prices of both tokens to fall in the short term. Despite being outperformed by Solana, on-chain data showed that market participants were paying attention to Chainlink.

Respite may come after the decline

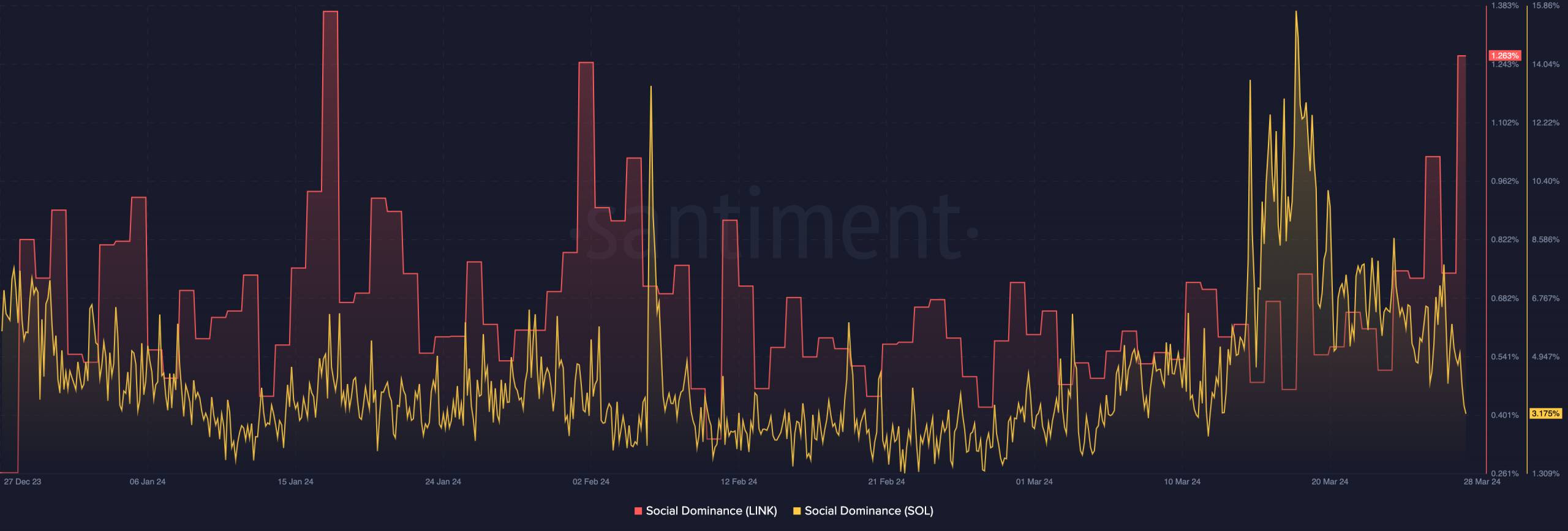

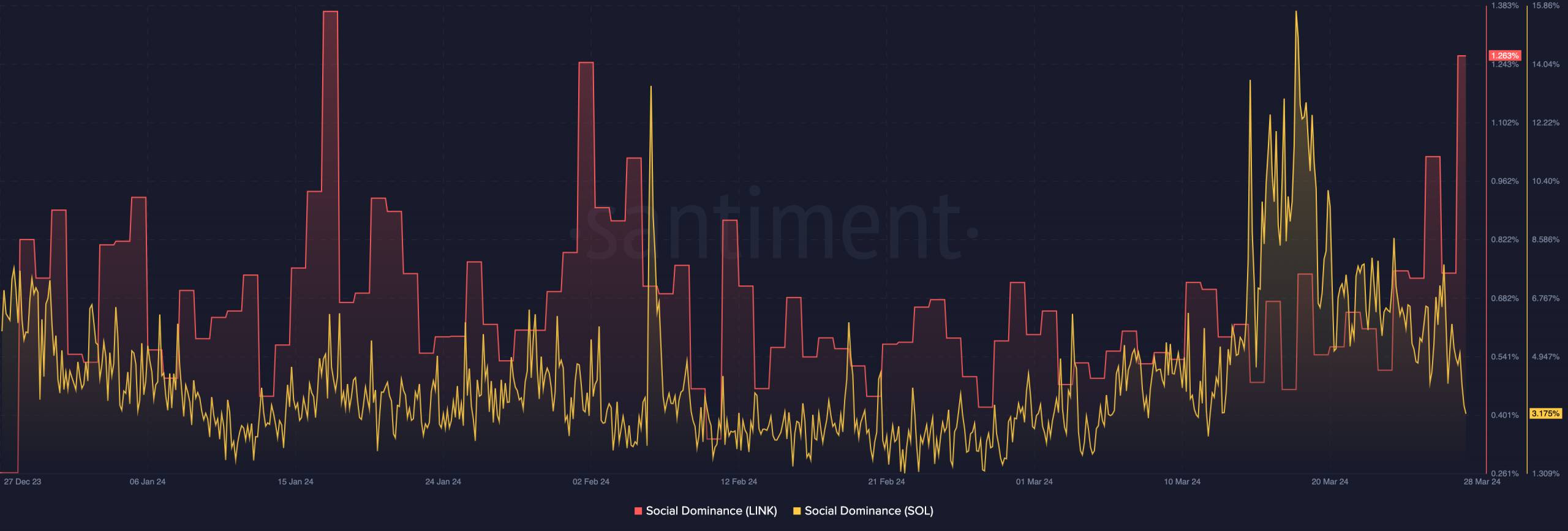

As of this writing, LINK’s social dominance rose to 1.263%. While Solana had a higher reading, the trend declined to 3.175%.

However, a high social dominance is not always a good sign for a cryptocurrency’s price. Likewise, a low reading of the metric indicates a higher potential for an increase.

Should the trend remain the same over the next couple of days, SOL might experience a price increase. While LINK has the potential to do the same, it might not be as grand as Solana’s prediction.

Source: Santiment

However, the post-halving performance of both cryptocurrencies could be bullish. Historically, Bitcoin loses its dominance days or weeks after the event. This allows altcoins to provide holders with more gains.

Realistic or not, here’s LINK’s market cap in SOL terms

As things stand, volatility might be extreme after the event, and prices of altcoins might swing between high ranges.

But when things stabilize, the conditions might change. If this is the case, SOL and LINK might hit new yearly highs. Irrespective of the performances, Solana might have a higher market cap than Chainlink.

Comments

Post a Comment