- Solana flipped MakerDAO in revenue, which consistently held the third spot in recent months.

- SOL jumped by more than 50% in the month.

Solana [SOL] ecosystem’s coffers were filled to the brink in March, following increased traffic on its blockchain.

Solana smiles all the way to the bank

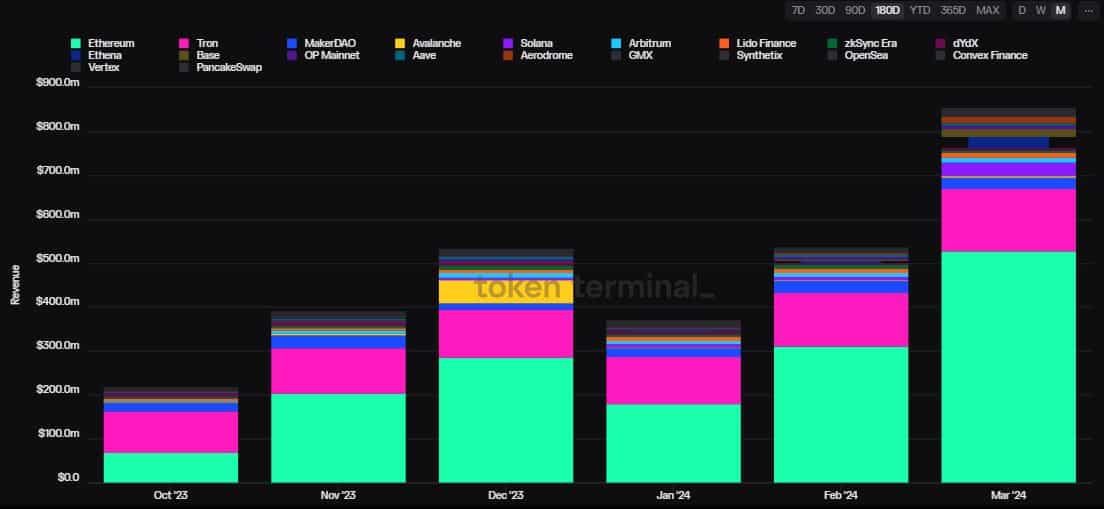

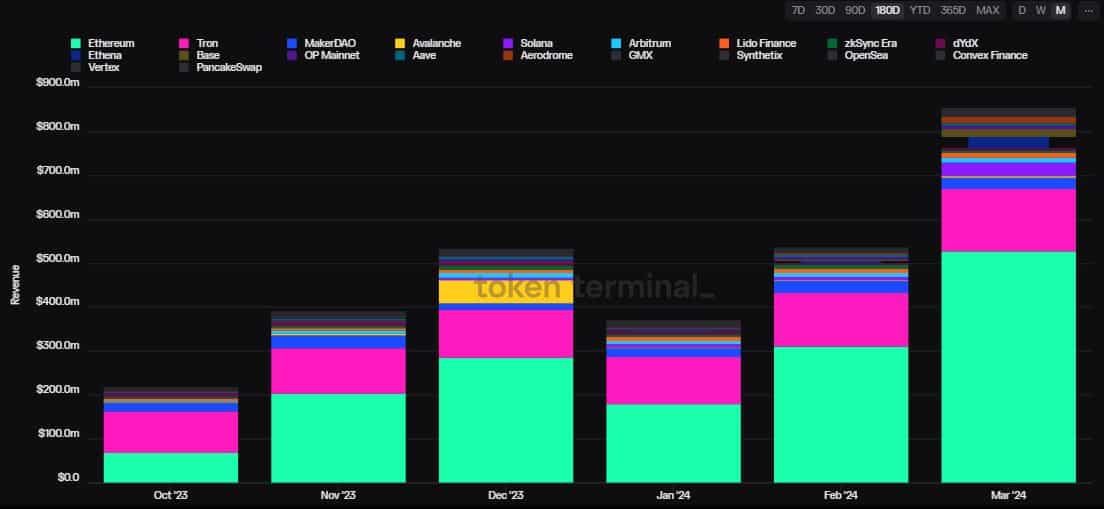

The smart contracts network raked in a whopping $31.58 million as of the 30th of March, as per AMBCrypto’s analysis of Token Terminal data, becoming the third-highest revenue generator in the broader Web3 industry.

Source: Token Terminal

Solana flipped lending protocol MakerDAO [MKR], which consistently held the third spot in recent months. Ethereum [ETH] and Tron [TRX] remained the top two revenue generators.

As obvious, the revenue uptick followed an explosion in memecoin trading on the platform. A barrage of coins were minted on the chain one after the other, drawing crypto degens who do not require a second invitation in such instances.

The speculation led to higher number of transactions, in turn generating significant fee revenue for the network.

SOL was one of the top performers in March

The ecosystem’s native token SOL reaped benefits from the blockchain’s increased utilization. The fifth-largest coin jumped by more than 50% in the month, becoming one of the biggest market gainers, according to CoinMarketCap.

Note that Solana burns 50% of its fee revenue, meaning that more the fees collected, more will be the deflationary pressure on SOL.

The price surge also got derivatives traders interested. According to AMBCrypto’s analysis of Coinglass’ data, the Open Interest (OI) in SOL futures increased to $2.74 billion at press time. This marked a 43% increase over the month.

A rising OI accompanied by a rising market value is indicative of a bullish market.

Source: Coinglass

Realistic or not, here’s SOL’s market cap in BTC’s terms

As of this writing, SOL was just 21% shy of its all-time high (ATH) of $249, set in November 2021. Popular crypto commentator Captain Faibik had recently predicted that the new ATH would be hit sometime in April.

If the forecast comes true, it would be some feat for the asset which plunged to $18 during the peak crypto winter of November 2022.

Comments

Post a Comment